#triochallenge Week 7 — Finance Dashboards

Vani: If someone would have told me two months back that I would be writing a blog on our ‘Week 7’ experience, I would have laughed out loud, because I never thought we would reach so far.

But well, here we are and all ready to share the experience of the most serious week.

This week’s challenge was to get our hands dirty with some real life business analysis. Although it’s a lot more easy to analyse and dig into topics which we generally find fun or get our creative juices flowing, we realised that working on actual business case studies and trying to analysing them from a financial point of view would do us some good and help us in getting decent understanding of how things are done in an actual corporate environment.

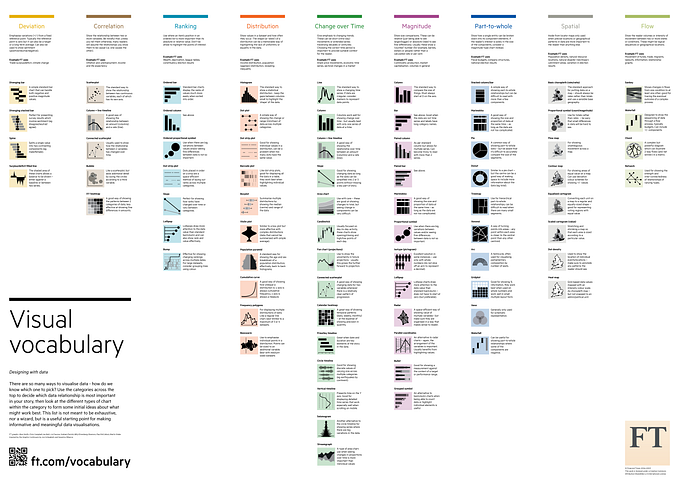

We all decided to chalk out some interesting analysis which would help companies to dig into their financial data better with the help of a visualisation.

After doing a lot of brainstorming, going through multiple financial visualisations online and looking at some really intimidating financial statements, we all finally came up with some ideas.

Employee Expense Analysis in Internal Audit management

Joti: The use of data analytics and visualisation has rapidly advanced in internal financial statement auditing, where many organisations use continuous auditing and continuous monitoring of data to identify risks and anomalies as part of their system of internal control.

I created dummy data to analyse the outliers in employee expenses for a firm and started with an overview of spending and expense areas to quickly see major expense areas with the help of a dot plot chart. This helped to filter out the areas which require a deeper dig.

The quadrant allows us to check the set of employees exceeding the allowed limits which I have made dynamic based upon changing limits of an organisation. Based upon this quadrant, individual employee transactions can be seen. This dashboard provides the starting point for further analysis.

Horizontal Analysis of Population Investment

Kavya: Horizontal analysis (also known as trend analysis) is a financial statement analysis technique that shows changes in the amounts of

corresponding financial statement items over a period of time. The statements for two or more periods are used in horizontal analysis.

Some points to note on the below horizontal analysis/trend analysis of CashFlow are -

1: Total Domestic Equity has the maximum Cash OUTFLOW in 3 years [ that implies maximum investment is done through this ]

2: People were seen trusting Equity over Bond hence there have been more investments than withdrawals i.e. more OUTFLOW than INFLOW.

Probable reason of more OUTFLOW than INFLOW could be the re-investment trend that most people follow. Negative amount doesn’t directly imply losses , it’s the trust shown on particular bond/entity by the people.

Financial Income Statements

Vani: I tried to make Income Parameter Performance KPIs as well as a performance report of Quick and Profitability Ratios.It really helped to learn a lot more about a company’s finances and to get a deeper insight into their working.

I hope we were able to deliver the basic understanding of finance domain through these use cases. See you in next blog!